Free Canadian Income Tax Software

To file your Canadian income taxes online, you first have to prepare your tax return using a commercial tax preparation desktop software package, a Web application or a product for an Apple or Android mobile device. These products must be certified for NETFILE.

Select the file you want to import. Toolbar: Standard. Allplan studentenversion download. Any information supplied with the file is now displayed - comments, bitmap, date etc.Note: The date indicates whether you have included the resources (line types, hatching styles etc.) when you created the NID file. Click Import NID File.

The table on this page will be updated throughout the software validation period, that is, until the end of March 2020.

You can refer to the table for the 2018 taxation year for information about which software has been validated previously.

The table below lists the software authorized by Revenu Québec that may be used by individuals to file the personal income tax return (TP-1-V).

It is your responsibility to find out from the software developer about any restrictions related to the use of the software. In addition, you must always use the most recent version of the software authorized for filing personal income tax returns. For more information, click Responsibilities of Software Users and Developers.

- If you are filing your income tax return online, do not mail us a paper copy of your return or any related documents.

- If you are filing an income tax return for the first time, you can use authorized software to do so.

We do not verify whether the software you are using takes into account all relevant tax legislation and correctly performs all calculations and data transfers. Consequently, we cannot be held responsible for programming errors that affect the calculation of income tax, contributions and premiums payable. Use of the software, and any omission or error in the information provided, is your responsibility and that of the software developer.

Certain developers offer the opportunity to use their software free of charge, subject to certain conditions. Before using the software, visit the developer's website to check whether your tax situation qualifies you for the offer.

| Software | Developer | Filing method | Features |

|---|---|---|---|

| fastneasytax | Fastneasy Services inc. |

| |

| Free TurboTax (Android version) | Entreprises Intuit Canada ULC (Intuit Canada ULC) |

|

|

| Free TurboTax (Apple version) | Entreprises Intuit Canada ULC (Intuit Canada ULC) |

|

|

| Free TurboTax (online version) | Entreprises Intuit Canada ULC (Intuit Canada ULC) |

|

|

| H&R Block Online | H & R Block Canada, inc. |

|

|

| SimpleTax | SimpleTax Software Inc. |

|

|

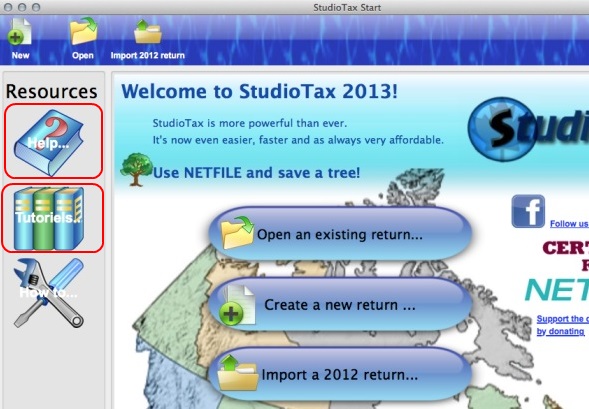

| StudioTax | BHOK IT Consulting |

|

|

| StudioTax for Android | BHOK IT Consulting |

|

|

| StudioTax for iOS | BHOK IT Consulting |

|

|

| TaxTron for Web | Taxtron inc. |

| |

| TaxTron Personal for Macintosh | Taxtron inc. |

| |

| TaxTron Personal for Windows | Taxtron inc. |

| |

| TurboTax | Entreprises Intuit Canada ULC (Intuit Canada ULC) |

|

|

| TurboTax Online | Entreprises Intuit Canada ULC (Intuit Canada ULC) |

| |

| UFile.ca | Thomson Reuters DT Tax and Accounting Inc. (Dr Tax Software) |

|

|

| UFile for Windows | Thomson Reuters DT Tax and Accounting Inc. (Dr Tax Software) |

|

|

Astounding Attributes

- Moron-simple: Designed to be as intuitive as possible because I know no one is going to read the Help file. All the forms are just like CRA's, only better.

- More than an adding machine: Taxman is full of clever code to save me from repeatedly making the same silly mistakes. With Taxman riding shotgun you get the experience of all the goof-ups I've ever made. And I've made plenty.

- Built-in tools: There's a dozen pop-up tools and every line on the tax form works like a mini-calculator (type 1+1 and you get 2). If you want to know what was entered on last year's return, just press F12 (perfect for the really lazy!).

- Work-saver: I used to do tax returns by hand, now I double-click. You only have to type it in once. Taxman copies data between forms, taxpayers and even between tax years. Check the bottom status bar for shortcuts that only an indolent accountant would come up with.

- Total control: Both program and data sit securely on your hard drive, nothing happens over the Net. Taxman doesn't interview you, you get to fill out the return any way you like (but if you need a plan?). And you can override anything the program calculates — verboten for netfile programs — which adds another chevron to Taxman's uniqueness.

- Pension splitting to the penny: No program on the market pension-splits like Taxman. There's no restriction that spouses live in the same province and Taxman doesn't just give one number as an answer. You get to see the entire search displayed in a table, all the inner workings, showing exactly how tax payable changes with every penny transferred.

Whatever program you're using, get a second opinion. Compare and see if Taxman's method can't get you a bigger refund.

Taxman used to work, now it doesn't!

Assuming you've rebooted the computer and you know that Taxman can only be run from its shortcut icon on your Desktop, all I can suggest is to re-install any full Taxman program. If the re-install doesn't work then, other than prayer, I don't have any tricks up my sleeve.

I've got a new computer/system, how do I bring in my old Taxman stuff?

You have to re-install one full Taxman program, then re-install the upgrades for whatever other years you want. If you're installing over top of your old files, then everything should now work. If you've installed into a new folder, then you have to replace the two newly-installed data files with your old data files (i.e. for 2015 you would bring in your old 15tables.mdb and taxbiz.mdb).

Isn't there a bug with the CPP at Line 308 and/or the overpayment at Line 448?

You must fill in CPP Earnings on the Worksheet correctly (read the Help guide), then all you have to do is hit the Update button. CPP contributions at Line 308 will be set and any difference from Line 308 and the total CPP contributions on the Worksheet will be entered at Line 448. CPP is all figured out on Schedule 8, but you don't even have to go there because the Worksheet fills it all in for you.

EI overpayment at Line 450 on Page 4 doesn't look right?

As with the question above, you haven't filled in Worksheet correctly. If you fill in EI Earnings for one T4 then you must fill it in for all T4s. If there is nothing on a T4 for EI Earnings, then you assume that all earnings are EI Earnings. Read the Help guide for more.

Problems with the latest Windows operating system?

There shouldn't be any. The latest full version of Taxman should install on any version of Windows and then any upgrade for any year will work.

To work correctly Taxman needs to run as an administrator. You can manually check on this by right-clicking the Taxman shortcut on your Desktop and then choosing Properties and then finding the Run as Administrator checkbox. Make sure it's checked off. Problems with Windows usually emanate from the User Account Control, which can be turned off.

If you're using pre-Taxman 2007 programs on Windows Vista or later, then the help file won't open unless you go to support.microsoft.com and search for winhlp32.exe and download the free upgrade.

When transferring data, if you get Error 3163 ('field is too small') see 2011 Bugs for possible cures.

Mac/Linux version?

Taxman needs Windows and Windows will run on a Mac — there's a utility called Boot Camp. As for Linux, I know nothing.

Printer problems!

On the menu look for PrintPage Setup where you can change printers and margins. Other than that, the program just puts out a call to print the page and then it's up to the operating system and the print spooler and the printer to get the job done. I've had problems too, but they've never been the program's fault.

Any Taxman programs for the years before 2005?

Sorry, no.

But why not Netfile?

As a tax professional I can't use Netfile which is limited to 20 returns. I have to use efile which you can't use. Plus, with electronic filing not all returns are permitted and you have to enter in more data than is demanded by a paper return. It all seems to me a ton of work with absolutely no reward.

How can I be sure Taxman won't steal my identity or financial information?

Once you download the program everything runs on your computer and Taxman will not link to the internet or try to email someone or mess with your computer. Your tax data is stored only on your computer. You run the show. There is no hidden way I'm making money off you.